If you’re worried about volatility in market returns, but want your money to grow, speak to your adviser about the Liberty range of High-Water Guarantee Funds, which give you all the benefits of the market upside, while protecting your capital on the downside.

Company failures happen, as do external market shocks, such as political changes or wars, but you can provide some protection for your capital with Liberty’s range of High-Water Mark Guarantee funds that give you all the benefits of the market upside, while protecting your money on the downside.

The High-Water Mark Guarantee was first introduced to the market when Liberty launched the Bold Living Annuity. It has subsequently also been applied to the Agile retirement annuity. This gives customers the freedom to make bolder investment choices by selecting higher-risk funds with higher expected returns and provides peace of mind that their downside risk is protected. The High-Water Mark Guarantee ensures that customers get every opportunity to maximise their returns.

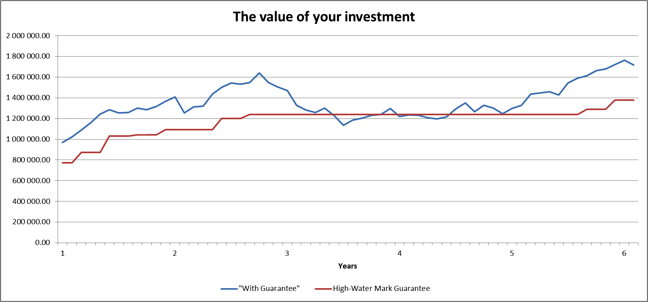

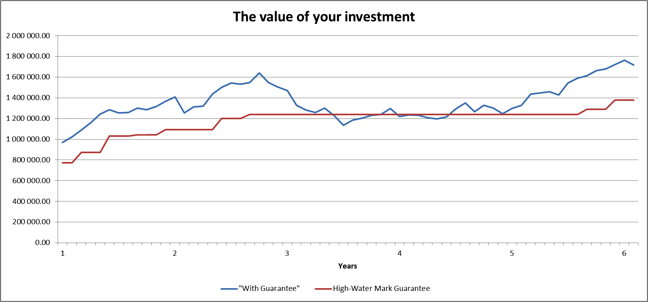

Each quarter, the fund will assess the cumulative return of the underlying funds selected by the customer and if a higher return is achieved, the quarterly High-Water Mark will be set at 80% of that high.

For example, on day one of the investment, the High-Water Mark would be 80% of the total capital invested. If, during the first quarter, the investment return from the underlying funds was 5%, then the high-water mark would increase to 80% of the new value.

This means that once your accumulated return reaches 25%, the High-Water Mark, or Guarantee, will be equal to your original capital invested. The quarterly High-Water Mark is never reduced, which means that from the start of your investment, your capital will never depreciate by more than 20%. Each quarter, 80% of any growth on the investment is effectively locked in, so if you had a negative quarter, the previous high-water mark would remain.

As with the fee structure for Liberty Evolve, with the High-Water Mark Guarantee you only pay for benefits you receive. There is a once-off guarantee charge of just 1% on the first day of the investment.

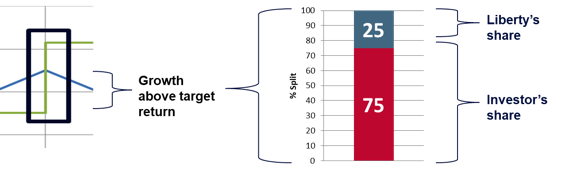

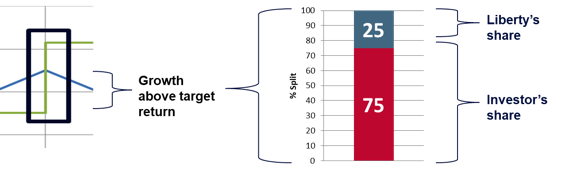

In the case of Bold Living Annuity, charges will only apply when an investor’s aggregate return exceeds 14%. If it does, we deduct 20% of any growth in excess of the 14% at the end of the year. For example, if the aggregate return is 20%, a fee of 20% on the 6% above 14% would apply – or 1,20%.

In the case of Agile Retirement Annuity, charges will only apply when an investor’s aggregate return exceeds 13%. If it does, we deduct 25% of any growth in excess of the 13% at the end of the year. For example, if the aggregate return is 20%, a fee of 25% on the 7% above 13% would apply – or 1,75%.

What happens when you hit the target return?

When your aggregate return reaches 25%, the 80% High-Water Mark will have risen to the level of your entire initial capital – in other words, the guarantee at that stage ensures no loss on the initial amount you invested (a 20% loss on 125% = 100%).

If you are still accumulating funds towards your retirement, speak to your financial adviser about the Liberty Agile Range.

If you want to protect your retirement income and still benefit from market growth, speak to your financial adviser about Liberty Bold.

Share this article:

Linked In | Facebook | Twitter | Email |