Anyone who was planning an overseas trip this year will be feeling shell-shocked by the fall of the rand. The recent sell-off in the rand is part of a wider disinvestment from emerging markets and is unlikely to reverse any time soon.

Unfortunately the rand's collapse is not just limited to holiday makers and will have a real financial impact on ordinary South Africans.

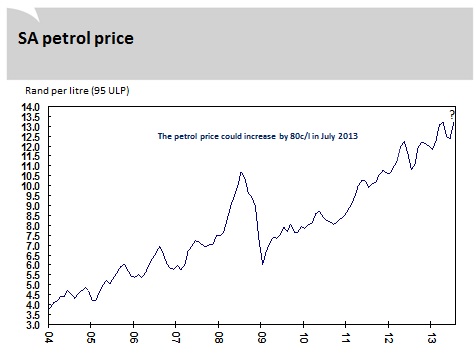

Paying more at the pumps

The petrol price is expected to rise by a further 80c per litre. This would hike the price of petrol (95 octane, ULP) up to R13.20 per litre – this is the highest on record. As a motorist you will be paying an additional R2.38c per litre to fill up your car compared to the beginning of the year. This 22% year on year increase means that for an ordinary car with a 50 litre tank, the cost of filling up will have increased by R119. This leaves less money to meet other necessary expenses. In ten years our petrol price has increased by more than 300%.

`

That smart phone just got more expensive

Although the recent inflation numbers came in lower than expected, the weaker rand increases the price of imported goods. South Africa still relies heavily on imported goods, including food, and these higher prices will eventually feed into the economy. The good news however is that given the weaker economy it is unlikely we will see the Reserve Bank increasing rates even if inflation does break through the 6% target range.

`

Your investments may have taken a tumble

The weaker rand was driven in part by foreigners selling off South African bonds and equities. This resulted in the JSE falling by over 4% over two weeks and the bond market falling 9%. Foreigners make up a significant portion of South Africa's investors and if they continue to remain negative on the currency we could see continued weakness on the JSE and bond markets. Rand hedge shares, companies that receive the majority of their earnings offshore, will however be the beneficiaries of the rand. This includes resource companies as well as British American Tobacco and SABMiller.

`

Upside for tourism

On the upside the weaker rand has made South Africa a far more attractive destination for tourists. Travel receipts, a figure issued by the SARB which reflects tourist spending in South Africa, rose by R2.2 billion in the first quarter of this year to R84.6 billion. This is the best level ever recorded and far exceeds the level of travel receipts recorded during the Soccer World Cup.

`

Good for local business

While importers may be complaining, local manufacturers will benefit from a weaker currency as it makes their products more affordable and we should see a shift away from imported to local goods. Exporters will also benefit as their products become more attractive to the overseas market as the prices fall in theforeign currency.

`