A paper on annuities in retirement that was delivered at a recent actuarial conference 1 sparked a debate around the appropriateness of

living annuities for the majority of retirees. National Treasury has also raised concerns about the over use of living annuities in

retirement which can result in retirees running out of funds in retirement.

The decision of whether to select a living annuity or guaranteed annuity in retirement can only be done on an individual level, taking

the retiree’s circumstances into account. It is important to ensure that when making this decision a retiree fully understands the risks

and benefits of the various options as there is always a trade-off.

Guaranteed Annuity

In terms of a guaranteed annuity, the optimal selection is for an inflation-linked annuity that will provide an inflation-linked income for life. The advantage is, firstly, that the retiree is able to plan with certainty. Secondly, their income will keep up with inflation. The disadvantage is that the guaranteed annuity dies with the retiree. If the retiree dies early in retirement there is no lump sum to leave his or her family.

Living Annuity

A living annuity is an investment from which the retiree can draw an income ranging from 2.5% to 17.5% of the capital each year. The advantage is that if structured correctly the retiree can leave a lump sum for their relatives upon death; the disadvantage is that retirees could run out of funds if they either draw down too high an income or if the market does not perform.

Investment Returns on a Guaranteed Annuity

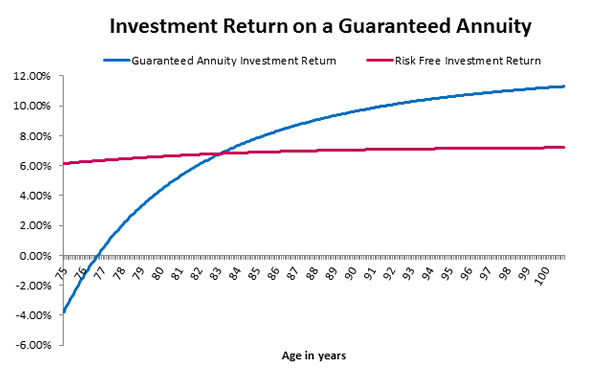

The blue line on the below graph is a plot of the annual investment return (as a percentage) on the initial upfront investment in a

guaranteed annuity. This is shown over time, represented by age. In other words, it represents the annual investment return the

retiree would have received on his initial investment at a given age considering the total income he would have received up to

that age.

Retirees who die early in retirement would have received less income and therefore a lower investment return. The longer he lives,

the more income he will receive and hence the higher the investment return. The investment return represented by the blue line in the

graph is guaranteed and therefore risk free. This means that the retiree’s income keeps up with inflation and is not affected by

fluctuations in the stock market.

Investment Returns on a Guaranteed Annuity

Based on the graph, if the retiree lives until age 90 he requires a risk free return on his living annuity of 10.5% p.a. to break

even with the monthly annuity received from the guaranteed annuity. However, if he only lives until age 80 the corresponding rate

drops to 3.5% p.a. If the retiree dies before age 77 the return on a guaranteed annuity is actually negative so any positive return

on a living annuity would result in a better outcome. This is because the value of the monthly annuity payments received from age

65 to 77 is less than the initial contribution.

The required investment returns above are net of all fees. So in actual fact they have to be 2% to 3% higher to cover average

fees on these type of products. Achieving a 13.5% risk free investment return, in the current environment, is not possible

but 6.5% (3.5% plus 3% for fees) is more reasonable.

Return required on a living annuity

Based on the graph, if the retiree lives until age 90 he requires a risk free return on his living annuity of 10.5% p.a. to break even with the monthly annuity received from the guaranteed annuity. However, if he only lives until age 80 the corresponding rate drops to 3.5% p.a. If the retiree dies before age 77 the return on a guaranteed annuity is actually negative so any positive return on a living annuity would result in a better outcome. This is because the value of the monthly annuity payments received from age 65 to 77 is less than the initial contribution.

The optimal solution

In an ideal world if we knew exactly how long we would live we could make the perfect investment decision. If we knew we would die

at the age of 70, we would invest in a living annuity and draw down the maximum income and enjoy life to the full. If we knew we were

going to live until we were 100, then we would want to benefit from a guaranteed annuity.

The final decision will be determined partly by how much capital you have compared to the income you require as well as your tolerance

for risk. The ideal investment is finding a balance between providing some guaranteed return but also knowing that capital will be left

to your family if you die sooner than expected. Having said that, if you expect to live for a long period into retirement it would be

very difficult to achieve the returns of a guaranteed annuity in a living annuity. (See article Living vs Guaranteed Annuities)

Based on a Guaranteed Annuity bought by a 65 year old male. Please note that the graph only shows returns between ages 75 and 100. The risk free rate above is the return available on government bonds and the difference between this and the blue line is the value added by a Guaranteed Annuity.

Risk pooling

The comparison between the red and blue graph shows the benefits of “risk pooling” or “mortality credits”. When a retiree purchases a Guaranteed Annuity they could in effect do the same thing by investing in another risk free investment and drawing down +- 6% of their income. The reason the guaranteed annuity rate increases over time is that the longer the retiree lives the more he benefits from “mortality credits”. In other words the retiree benefits from the funds invested by other retirees who died earlier. This is a cross-subsidisation of risk in much the same way as insurance works. The life company does not “benefit” if you die young, but it is the other retirees in the investment pool’s benefit.

1 Living versus guaranteed annuities: in search of a sustainable retirement income by Mayur Lodhia and Johann Swanepoel